In 2024, we received 85,310 calls, spending more than 11,670 hours

supporting 31,592 Members across Maine and beyond.

It’s no secret that Members, employers and the healthcare industry are facing significant challenges when it comes to accessing care. At Community Health Options, we’re focused on finding new ways to help Members get the care they need.

In 2024, we expanded virtual care options, found new ways to lower out-of-pocket costs, and formed new partnerships to help our Members save time and money.

Firefly by the numbers

In its first year partnering with Community Health Options, Firefly achieved a 93% Member satisfaction rating.

Quality care from anywhere

Health insurance, the way it should be

At Community Health Options, our purpose is simple: We provide Members with benefits they can actually use. We focus on helping our Members get access to the care they need while working to lower out-of-pocket costs. In 2024: Learn more about the benefits of virtual careRead Article

- We introduced a $25 copay for labs at select NorDx and Quest locations and a $75 copay for X-rays at specified locations for almost all Large Group non-HSA plans. HSA Members have a copay or coinsurance after reaching their deductible. Learn more about saving through our Site of Service programs here.

- We expanded alternative treatments by adding acupuncture benefits to all 2024 Large Group plans and select Individual and Small Group plans.

- We began providing coverage (with Prior Approval) for the Freestyle Libre or Dexcom Continuous Glucose Monitoring System and select GLP-1 medications for Members with diabetes. Details can be found on the company’s formulary.

These benefits are also available to self-funded clients who choose to add them to their plans.

When a home healthcare agency mistakenly ordered incorrect ostomy supplies, a Member began purchasing them herself online, incurring out-of-pocket expenses.

When her care manager found out, she assured her the supplies would be covered under her health plan and found three in-network suppliers to help her get what she needed.

A new plan administrator for CarePartners

In 2024, in collaboration with MaineHealth, we became the new plan administrator for CarePartners, a program providing free or low-cost healthcare to low-income, uninsured adults.

Community Health Options provides enrollment cards that work similarly to health insurance cards. These cards reduce the stigma of being uninsured and give members access to health care services and certain prescription medications. View the Press Release.

When a new Member discovered on the Friday before a holiday weekend that she'd need to use Accredo for her specialty medication, she was concerned about getting her next dose in time.

Fortunately, the Pharmacy team found her medication in stock locally and collaborated with Accredo to get the prescription filled within a few hours.

Community Health Options offers programs and tools to help Members achieve their wellness goals, no matter where they are on their health journey. Maine Nonprofits receive $50,000 in Wellness GrantsLearn More

Wellness Tools

Select plans include a digital wellness platform and mobile app through WellRight at no cost to Members aged 18 and older. Now in its second year, the program has gained traction with thousands of our Members having active accounts.

Wellness Grants

In 2024 we awarded $50,000 in Wellness Grants to 10 Maine nonprofit organizations, supporting programs that promote both physical and emotional well-being in communities across the state.

Putting people first: key partnerships for better care

Community Health Options builds strong partnerships to enhance access to care and to achieve cost savings for its Members.

Community Health Options builds strong partnerships to enhance access to care and to achieve cost savings for its Members.

In 2024 key collaborations included a successful pilot with Twig Health, which utilized text, AI, and nurses to encourage A1C testing among Members at risk for high blood sugar. This program saw 49% participation, with half of those individuals immediately scheduling tests, leading to an expansion in 2025 to cover all aspects of diabetes care.

Another partnership with a Maine-based practice focused on helping providers close care gaps for diabetic Members, resulting in 50% of contacted Members lowering their A1C levels. Additionally, our ongoing collaboration with Accredo, a specialty pharmacy, has saved Members $2.2 million on specialty medications through copay assistance programs, demonstrating Community Health Options' commitment to personalized care for complex and chronic conditions.

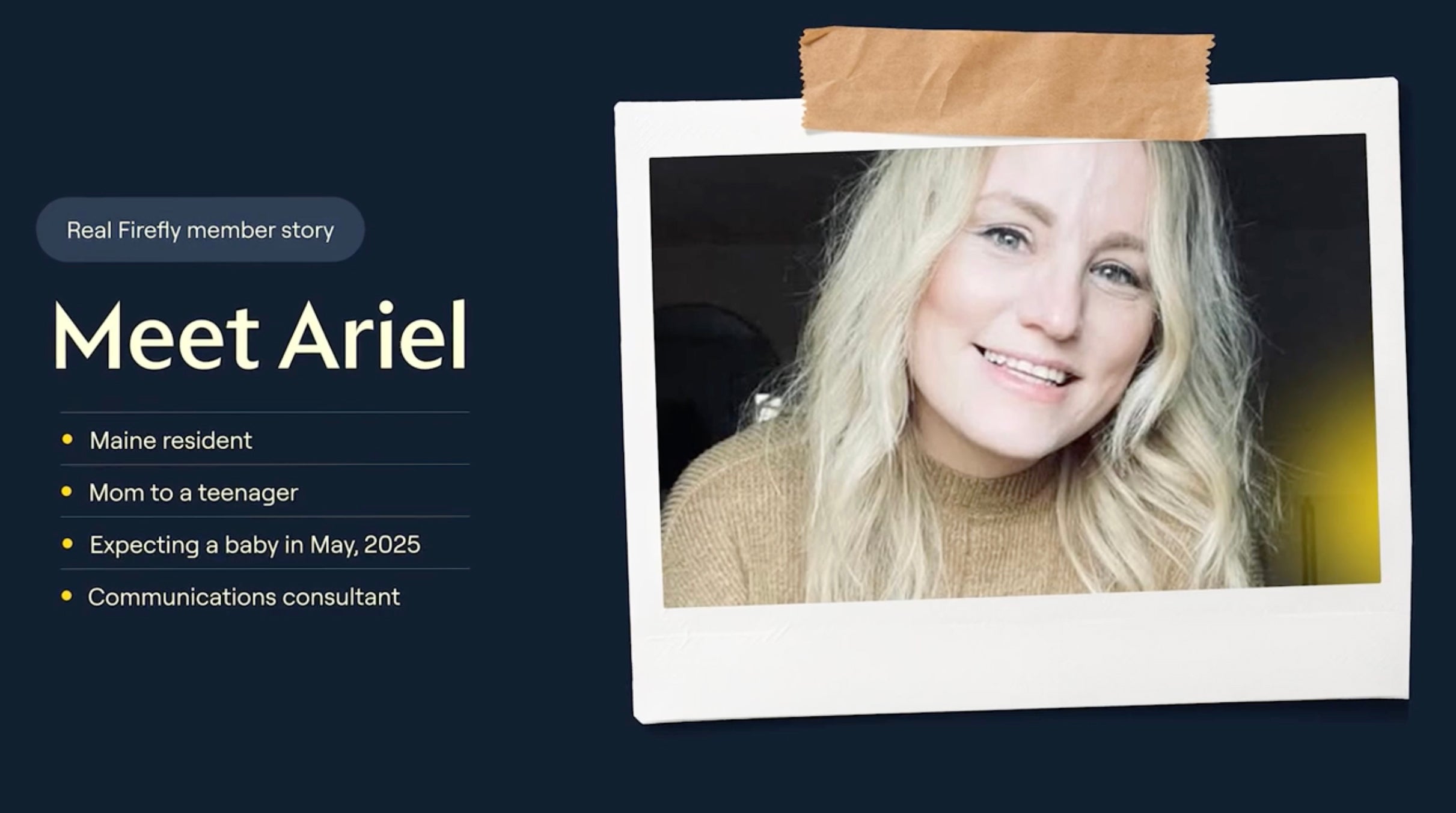

After beating breast cancer, a Member without a PCP needed referrals for follow-up screenings and support for her health goals. Her care manager suggested virtual care through Firefly.

Weekly check-ins with a health guide led to a healthier lifestyle. When new health concerns arose, timely referrals for in-person treatment ensured prompt care. This reduced stress and improved her overall well-being, allowing her to stay focused at work.

Last year, we expanded our Large Group business throughout the state. Our focus is simple: keep employees healthy and their healthcare out-of-pocket costs low. Instead of continually refining our plans to make them more profitable, we’re focused on making them more practical, helping employers to reduce expenses, attract talent and improve the health and productivity of their workforce.

Last year, we expanded our Large Group business throughout the state. Our focus is simple: keep employees healthy and their healthcare out-of-pocket costs low. Instead of continually refining our plans to make them more profitable, we’re focused on making them more practical, helping employers to reduce expenses, attract talent and improve the health and productivity of their workforce.

For Large Groups, we launched our 13-point Partner Promise with quantifiable, time-based commitments to ensure service-level guarantees for activities like high-cost claimant assistance, complex care support, new Member outreach, prescription cost reductions and wellness support. Recognizing that it’s about choice, we began offering customized cost sharing on plans for groups of 100+ enrolled employees.*

With a 99% client satisfaction rate and 92% group retention, we are proud of the products and services we provide our clients.

Note: *Cost sharing customization is available on deductibles, maximum out-of-pocket, copays and coinsurance.

A care manager connected with a Member who had spent five years searching for a therapist to address her PTSD.

Despite facing several obstacles in her search, the care manager directly contacted a local therapist and arranged an introduction. The personal approach enabled the Member to schedule her first appointment within a week.

We do health insurance differently.

As a Maine-based nonprofit health insurance company, we operate differently. We're not driven by shareholders or corporate bureaucracy. Instead, we're led by our Members. This allows us to prioritize our Members' health and well-being above all else, ensuring they get the care they need to say healthy. It's a simple idea, but one that sets us apart

in the often-complicated health insurance industry.

| Assets | |

| Bonds | $100,270,907 |

| Cash, cash equivalents, and short-term investments | $6,033,314 |

| Subtotals, cash and invested assets | $106,304,221 |

| Investment income due and accrued | $623,351 |

| Premiums receivable | $589,087 |

| Accrued retrospective premiums and contracts subject to redetermination | $436,000 |

| Amounts recoverable from reinsurers | $8,154,412 |

| Amounts receivable relating to uninsured plans | $196,596 |

| Healthcare and other amounts receivable | $7,954,359 |

| Total Assets | $124,258,026 |

| Liabilities | |

| Unpaid claims and claims adjustment expenses | $32,989,629 |

| Accrued medical incentive pool & bonus amounts | $840,762 |

| Aggregate health policy reserves | $34,746,815 |

| Premiums received in advance | $3,946,481 |

| General expenses due or accrued | $5,715,138 |

| Ceded reinsurance premiums payable | $373,335 |

| Amounts withheld or retained for the account of others | $2,500 |

| Liability for amounts held in uninsured plans | $88,188 |

| Other Liabilities | $71,466 |

| Total Liabilities | $78,774,314 |

| Capital and Surplus | |

| Surplus notes | $132,316,124 |

| Unassigned deficit | ($86,832,412) |

| Total Capital and Surplus | $45,483,712 |

| Total Liabilities, Capital and Surplus | $124,258,026 |